-

Chart Industries Completes the Acquisition of Howden

Источник: Nasdaq GlobeNewswire / 17 мар 2023 08:45:00 America/New_York

- Creates a differentiated leading offering across stationary and rotating equipment for multiple applications and end markets, including industrial gas, hydrogen, LNG, water treatment, carbon capture, and energy transition

- On track to meet or exceed its previously announced targets for $175 million of annualized cost synergies and $150 million of commercial synergies in the first 12 months of ownership

- Provides calendar year 2023 guidance for the addition of Howden in line with previously communicated ranges

ATLANTA, March 17, 2023 (GLOBE NEWSWIRE) -- Chart Industries, Inc. (NYSE: GTLS) (“Chart”), a global leader in engineering and manufacturing of process technology and equipment for industrial gas, specialty and energy transition markets, has completed its acquisition of Howden, a leading global provider of mission critical air and gas handling products and services, from affiliates of KPS Capital Partners, LP (“KPS”).

The strategic combination of Chart and Howden expands our offering of products and solutions across the Nexus of Clean™ -- clean power, clean water, clean food and clean industrials. The combination also provides access to new specialty products and ESG-linked end markets such as nuclear, energy recovery and electrification. The complementary nature of the equipment and solution portfolios results in a differentiated offering across stationary and rotating equipment and is further differentiated by the additional 750 Howden engineers coming with the acquisition, doubling our global engineering team to over 1,500.

Chart paid a purchase price of approximately $4.4 billion in cash, before customary purchase price adjustments. Chart funded the purchase price and the payment of acquisition-related expenses through a combination of cash on hand, the proceeds from previously consummated debt and equity financings and the proceeds from a tranche of term loans that closed concurrently with the acquisition. As a result of Chart’s cash on hand and the debt and equity financings, the purchase price was paid solely in cash and no preferred stock was issued (to KPS or otherwise).

“We are excited to welcome the Howden team to the Chart family and look forward to the combined business executing on record momentum and well-defined synergies,” stated Jill Evanko, CEO and President of Chart. “Since we announced the combination in November 2022, Chart has received numerous inbounds from customers that see the combined benefits we can offer.”

Through the acquisition of Howden, Chart has gained immediate access to new customers and commercial opportunities, increasing our geographic footprint to over 35 countries. This geographic footprint allows for increased commercial and manufacturing capabilities as well as the ability to bid on projects regionally that were not previously accessible. As a result, Chart is on track to meet or exceed its previously announced targets for $175 million of annualized cost synergies and $150 million of commercial synergies in the first 12 months of ownership.

Aftermarket, service and repair will represent approximately 30% of the combined organization with approximately 42% gross margin as a percent of sales. The increased global reach, coupled with two large existing installed bases, will result in less business cyclicality. We will also leverage Howden’s digital offerings of Uptime and Ventsim across our global installed base.

The new Chart executive management team will include a balance of Chart and legacy Howden executives. We will continue to operate under our “One Chart” commercial and engineering structures, further allowing us to leverage our full solution set across our diverse end markets.

Both companies continue to see strong demand in the first quarter 2023. Chart’s orders quarter-to-date through March 15, 2023 are above $520 million.

Gross order intake for Howden in the fourth quarter 2022 was $534 million, a new record high, and for the full year the gross order intake was $2,064 million. Notable is the continued strength in the area of renewable hydrogen with orders up 47% for the full year. Backlog as of December 31, 2022 for Howden was $1.3 billion.

Potential Divestitures

As previously disclosed, Chart is pursuing the divestitures of two product lines related to the combined business. While there can be no assurances we will complete these divestitures, we are progressing with discussions with potential buyers. We anticipate progressing to completion either in the second quarter 2023 or early third quarter 2023.

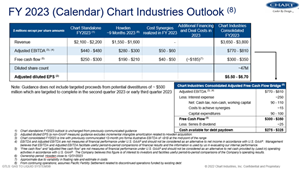

Full Year 2023 Guidance

Chart is providing the following update to 2023 calendar year guidance based on approximately nine months of ownership for Howden. Therefore, our 2023 calendar year outlook includes a full year of Chart (with respect to which our prior outlook is reiterated), and approximately nine months of Howden ownership and related cost synergies. Specifics can be found in the supplemental presentation released this morning in conjunction with this press release.

Future Company Events

Chart is scheduled to present at the Bank of America Global Industrials Conference in London, England on March 21, 2023 at 12:15 p.m. Greenwich Mean Time (8:15 a.m. Eastern Time). A webcast of this event will be available at Chart’s investor relations website.

Chart is scheduled to report first quarter 2023 earnings on April 28, 2023. Additional dial-in information will be provided prior to the event.

Chart will host an Investor Day at the New York Stock Exchange on Tuesday, November 28, 2023. Registration information will be posted to our investor relations website prior to the event.

Forward-Looking Statements

Certain statements made in this press release and the accompanying supplemental presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning Chart’s business plans, including statements regarding anticipated acquisitions, future cost synergies and efficiency savings, objectives, future orders, revenue, margins, earnings, performance or outlook, business or industry trends and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “indicators”, “outlook,” “guidance,” "continue," “target,” or the negative of such terms or comparable terminology.

Forward-looking statements contained in this press release or in other statements made by Chart are made based on management's expectations and beliefs concerning future events impacting Chart and are subject to uncertainties and factors relating to Chart’s operations and business environment, all of which are difficult to predict and many of which are beyond Chart’s control, that could cause Chart’s actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause Chart’s actual results to differ materially from those described in the forward-looking statements include: Chart may be unable to achieve the anticipated benefits of the acquisition (including with respect to synergies); revenue following the acquisition may be lower than expected; operating costs, customer losses, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers and suppliers) resulting from the acquisition may be greater than expected; slower than anticipated growth and market acceptance of new clean energy product offerings; inability to achieve expected pricing increasing or continued supply chain challenges including volatility in raw materials and supply; in ability to complete certain divestitures; risk relating to the outbreak and continued uncertainty associated with the coronavirus (COVID-19) and the conflict between Russia and Ukraine, including potential energy shortages in Europe and elsewhere and the other factors discussed in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully. Chart undertakes no obligation to update or revise any forward-looking statement.

Use of Non-GAAP Financial InformationThis press release and the accompanying supplemental presentation contain non-GAAP financial information, including estimated future cost synergies, commercial synergies attributable to Chart as a result of the acquisition. Chart believes these forward-looking non-GAAP measures are of interest to investors and facilitate useful illustrations of Chart’s estimated future financial results, and this information is used by the Company in evaluating internal performance. Chart is not able to provide a reconciliation of each non-GAAP financial measure presented because certain items may have not yet occurred or are out of the Company’s control and/or cannot be reasonably predicted.

Contacts

Chart Industries, Inc.

John Walsh

VP, Investor Relations

1-770-721-8899

john.walsh@chartindustries.comA photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d88b09e9-e1ef-401d-9884-a8a0db7cc3b1